Economy

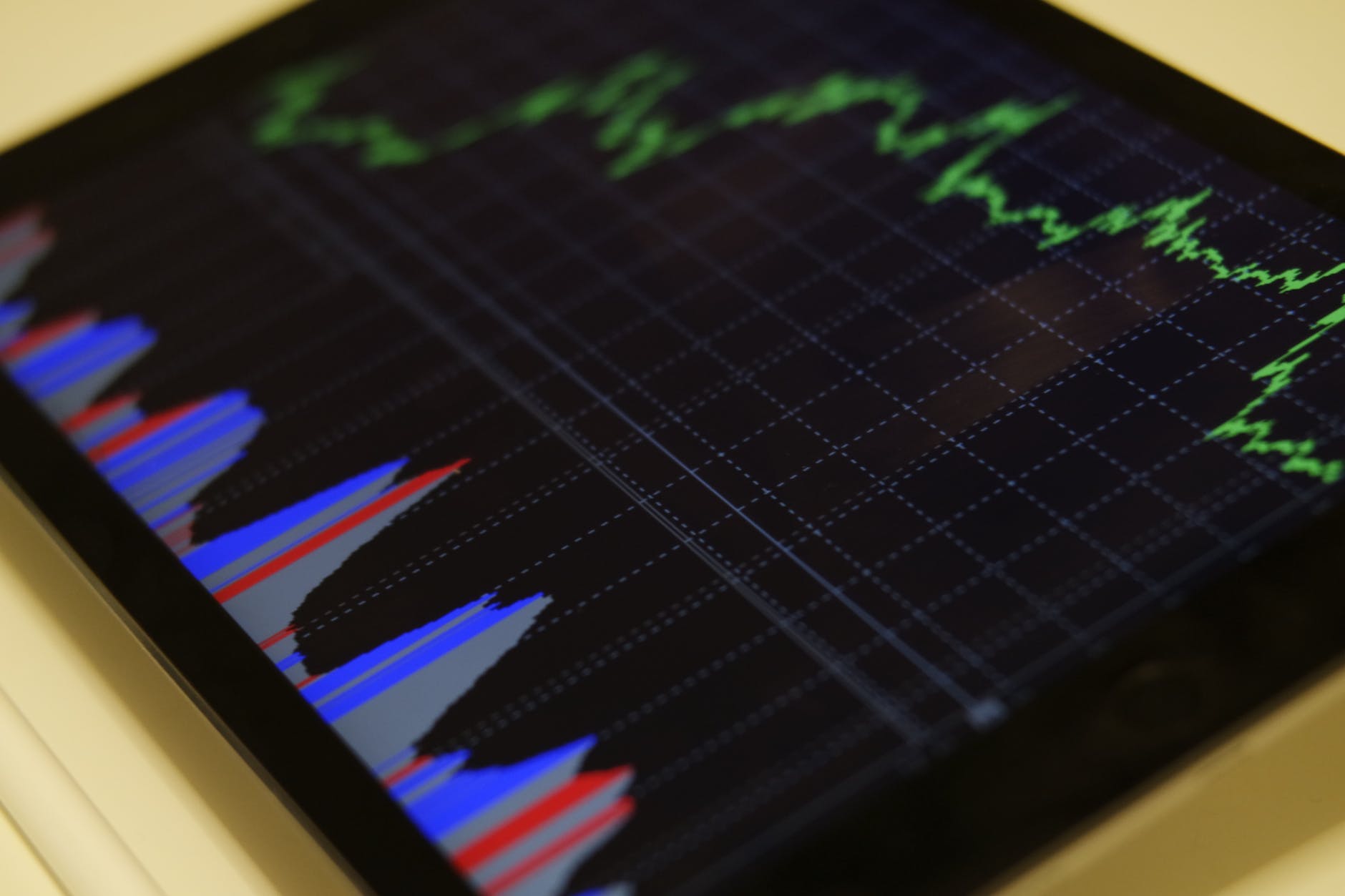

What Can The US Govt Do To Help The Stock Market?

Unless you live under a rock, you will know the stock market has plunged this past week. ‘Plunged’ may be an understatement as the Dow fell by 1,500 points, a new intraday record. But, there is no room for congratulations on laying this new ground, not even for the Trump administration. Remember, this is a government that waxed lyrical about the state of the Dow Jones hours before the slide.

Although the White House is now nothing if not unpredictable, top members of the cabinet will be looking to strike back. The economy is Trump’s ace in the hole, and it seems to be tanking hard. But, the stock market isn’t a leaky faucet which you can tighten in a couple of seconds. So, what can the WH do to ease the drop?

Here is a selection of tools at their disposal, and a wrench isn’t one.

Do Nothing

Absolutely nothing if the past behavior of the Trump government is any indication. But, this isn’t out of sheer laziness or lack of understanding this time. It’s because the slide is, in part, due to a lack of confidence in the market. Investors expect interest rates and inflation to play a massive role in the not-too-distant future and are pulling out. So, doing nothing may be the key to the door for the White House. At least, it’s what Joe LaVorgna, chief economist for the Americas as Natixis, believes. Speaking to CNBC, he thinks it’s a move against the Fed because it isn’t aggressive enough, which has led to a sell-off. And, one pertinent thing to remember is that there wasn’t a single piece of info that led to the exodus. Even though it resembles the 2010 Crash, the details aren’t the same.

Speak To The Fed

Trump is by no means an advocate of government intervention unless it involves scandal. However, he may change his mind in this instance when a simple solution is at hand. As LaVorgna said, there are lots of investors that think this slump is down to the Fed and that it isn’t doing its job. Why? It’s because they are doing nothing to allay people’s’ fears. Interest rates, as well as inflation, are the big issues as the money-makers dread the increasing regulation. After all, reports suggest hourly earnings rose by 2.9% last Friday before the incident. Simply asking the bank to calm the situation could be the easiest and cleanest route for everyone. But, don’t cross your fingers because the Trump WH doesn’t do straightforward.

Point To The Facts

No one likes to side with this government unless they are sycophants, but the stats are there for everyone to see. The market spiraled out of control as investor confidence hit an all-time low, yet there wasn’t much evidence to suggest why. After all, bond yields on the day were lower than before, which should have eased fears. Plus, there is the position of the S&P. Although it isn’t as reputable as before 2010, it’s still a decent indicator and it is trading as normal. In January, the moves were almost identical to the ones made in December. In layman’s terms, it means the market isn’t going to have to analyze a year of returns. The govt doesn’t have the credibility to point to the facts after its assault on the truth, but they can gesture to the likes of Michael Yoshikami.

Confidence Boost

The White House will undoubtedly act as if nothing is wrong, and they may be right. However, even if this is just a recalibration, there is a mental element. Trading and investing require strong-minded people to spot patterns and take calculated risks. No one is going to do that while the Dow swings up and down like a yo-yo. His only option is to instill confidence back into the system that he dearly treasures. Again, speaking to the Reserve would be a start as it may prevent it from tightening the belt. But, there are other options too. One which experts agree on is the element of AI-led investment software. Currently, the rise of technology means there’s a gap in trading which is being exploited by these programs. As a result, the anomalies are leading to drops such as the storm that is currently hitting the market. Only 10% of stocks are traded by individuals, and that is a problem because computers are aggressive.

Increase Transparency

You may have noticed that there is a Mexican standoff between investors and the government. Stood there with their guns in hand, no one wants to shoot first. The reason is simple: a lack of communication. All of the above has happened because of a perceived hike in interest rates and inflation, but there are no guarantees. As in 2008, the barriers surrounding the stock market are preventing people from making informed decisions. ‘Make America Great Again’ is the slogan, but Trump may want to look to Europe for help. MiFID II Trading Solutions is an EU regulation that tries to make markets open, transparent and resilient. Regulation isn’t the government’s strong point, especially as the rise in the Dow as a result of market freedom. However, a lucid program could make the situation clearer for all parties.

Close Down The Shutdown

If you aren’t aware, again, where have you been living? The US government shutdown for the second time this year on Friday morning, and is a huge problem. The men and women that have to work out how to deal with a national problem work in the Capitol building. Without them doing their jobs, there isn’t going to be a quick fix. And, it isn’t as if Trump himself burns the midnight oil according to reports detailing his daily schedule. The US needs all areas of government up and running and working together if it is going to get out of this mess with any credibility. While the shutdown is still in process, the odds get longer and longer.

What are your views? Is this a big deal or is it just a flash in the pan?

Economy

Protecting Your Business From Rising Fuel Costs

The cost of fuel is soaring globally, due to various factors, including the coronavirus pandemic and the ongoing conflict in Ukraine.

Businesses everywhere are feeling the burden that comes with increased energy costs. However, there are a number of things that experts have determined companies can do to fight back and protect their businesses from rising fuel costs.

Implement green measures

Dusistainbility has been a big trend in global business in recent years. Companies that have not yet embraced measures such as the paperless office and the use of solar power, many find that doing so now could help to offset some of the extra costs arising due to higher gas, oil, and electricity prices.

A four-day week

The benefits of a four-day week for employers and their employees have long been debated, but there is a lot of evidence to suggest that companies can be run just as efficiently in four days as they can in five. This could give companies struggling with the cost of heating, and lighting their offices, or running their machinery the opportunity they need to protect their business from fuel costs without losing money.

Should a factory, for example, close for one extra day per week, they would save 20 percent of its operating costs, and studies have shown that employees who work four days a week are around 20 percent more productive, which means they could save a great deal on the ongoing cost of fuel, without ruining their productivity or losing revenue. Many experts believe this to be a win-win situation.

Special offers

Of course, when the price of fuel rises, in certain industries, customers may be affected by those costs, and therefore less likely to make the same level of purchases they once did. Companies who find themselves in this position need to do whatever they can to encourage customers to buy.

For example, Volvo Penta, which sell luxury yacht and marine engines, among other applications, may find that due to the cost of fueling a vessel, fewer people are going out o their boats, causing sales to drop. By making special offers or putting together attractive packages, they can encourage more purchases to be made. If the product is good, and the price is right, it is easier to weather this particular storm.

Downsizing

Now that remote working is easier than ever, downsizing office space is set to be another important way that companies around the world can protect themselves from the rising cost of fuel. The fewer employees who need to be in the office or onsite, the smaller the office space can be, and the fewer resources will be required to keep it running smoothly, so expect to see more homeworking going forward.

The cost of fuel may be set to rise even further in the Autumn, and no one knows exactly what will happen beyond that, but there are a number of things businesses can do in mitigation, so it is almost certainly not time to panic yet.

Economy

Joao Vale e Azevedo: pessimistic prospects could be tackled by collectivity

As we enter the new year, the effects of 2021 are now echoing in the economy in 2022. According to the World Bank’s latest Global Economic Prospects report, global growth is expected to decelerate markedly from 5.5 in 2021 to 4.1 in 2002 and 3.2 percent in 2023. This has been proposed both in the case of developing and major economies, such as the case of the United States.

In 2021, governments around the world have suggested that it was a year of rebirth. However, current numbers are not showing that and so not everyone is trusting on this bet. This is the case of Joao Vale e Azevedo, chairman of KUNST Global – an equity firm based in London, Geneva, Zurich and Luxembourg. For him, the forecast is still negative for 2022 as inflation keeps on running critically in the US and in many European countries. But unlike in the 1970s and 1980s, the solution won’t lie in governments printing money like they did in the past.

The chairman of KUNST Global also doesn’t think that the so-called commodity crisis is temporary as the news might say. In fact, Azevedo believes that there is more to it than the effects of the pandemic. While the Covid-19 crisis has ignited the growth of e-commerce, Azevedo claims that this intensification in demand for goods would happen anyway and the problem is actually in the distribution industry: “It is unable to meet this increased demand. There is no labor, no trucks, nor ships. The offer is no longer able to meet the market demand and this is not a contingency, it is a physiological fact.”

Finally, the third and possibly the most concerning problem is the price of energy. “This is really a worrying question, and not only for our distant future, as it has been up to now, but also for our present,” explains Azevedo. “We are witnessing it on a daily basis: electricity and gas bills have skyrocketed. Families and companies, which were already suffering from the pandemic, do not know how to cope with the increases.”

Although propositions like moving from coal to gas or from oil to electricity may point the way out, Azevedo thinks we are completely deprived of the infrastructure and funds necessary to manage this change. What is more, the chairman of KUNST Global argues that present politics lacks long-term vision, which means politicians are often too focused on electoral cycles instead of considering the future – thus mining any possibility of investments for change.

In addition to that, Azevedo has been keeping a close eye on the war in Ukraine. In his opinion, if Russia persists in carrying on the war, not only this country will be doomed to bankruptcy, but the whole West could face a domino effect. “Regardless of this, the war in Ukraine means greater market instability, rising energy prices that are already out of control, and a further increase in inflation, which could reach double the current levels,” he adds.

However, not all hope is lost. Hopefully, the war in Ukraine will find a rapid resolution, which is something that could catalyze even more this sense of collectivity that Joao Vale e Azevedo sees growing after two years of pandemic. “The fact that we have had fewer opportunities for interaction has meant that we are now more aware of the value of those interactions, and probably also of human life. We are a stronger community. The challenges that await us are very difficult, but together we are much better prepared to face them,” he concludes.

Economy

How People Around The World Are Investing Their Money

One thing that everyone should aim to do with their spare cash is to invest it – as wisely as possible, but at least in a way which is going to lead to potentially high returns. If done correctly and with a bit of good fortune, it is perfectly easy to improve one’s wealth to a considerable degree this way, and it is therefore well worth people considering this.

As it happens, there are a lot of investment options that people are making use of all over the world, with some that are especially popular right now. Let’s take a look in some detail at some of the major ways in which people are investing their money – and making some considerable gains, in many cases.

Stocks & Shares

Arguably one of the most popular forms of investment is stocks and shares – which can be incredibly lucrative if it is done in the right way, and with the right set of circumstances behind an investment. Indeed, stocks and shares remain the number one investment that people are engaging in every day throughout the world, and with good reason. Not only is it potentially something that can bring considerable returns, it is also relatively straightforward to get into and learn at least the basics of, making it a very simple and easy form of investment for most people.

It also doesn’t require a huge amount of money to get going – although having that is obviously not going to hurt one’s chances of success starting out! In fact, it’s doable to get going with stocks and shares with literally a few spare pennies – so it really is something that pretty much anyone can get into and make use of. It can also be a good way to diversify and widen out a portfolio that may include other forms of investment as well.

Savings Accounts

Although many people think of investment and savings as two different things, they are really just two sides of the same coin. You can think of saving as a form of investment, especially if it is done in the right manner and with the right approach. Of course, in order to find success with this, it is important to make sure that you are choosing the best savings account there is. That means one that has a high enough interest rate for it to be worth it, as well as having other functions that might be important to an individual – such as the ability to take money out whenever you need to, for instance.

With interest rates diving all over the world, this is quickly becoming one of the less popular forms of investment – but for now it is still worth considering, as it can be a good way to at least store your spare cash as necessary. If nothing else, you’ll probably find that you are able to find yourself in a much better financial position this way soon enough, even if that doesn’t happen as quickly as it might with certain other investments.

Cryptocurrencies

Although there is some controversy around cryptocurrencies, there is no doubt that it is one of the world’s most popular forms of investment right now. There is also no doubt that it’s possible to make a lot of money this way – as some of the world’s richest people have done so already. Even in a much lesser sense, however, it is perfectly possible for an individual with a regular amount of wealth to make money investing in cryptocurrencies. And generally, this is done in a few key ways.

First of all, you can simply buy some crypto and then hold on to it, hoping for its value to improve and selling it on once it has done so. Alternatively, you might want to consider trading crypto coins by buying one kind and then trading into another as you think it might be lucrative. This takes a bit more knowledge, patience and skill, but the returns can be significant. Either of these can work very well, however, and they are worth thinking about at the very least.

A related form of investment, in that it too relies upon blockchain technology, is NFTs. These pieces of art can be bought and traded as above, and some of them are creating huge amounts of money for people right now, so it might well be worth getting into.

Spread Betting

Another form of investment that a lot of people are getting into in the past few years is something known as spread betting. This is where you place bets on a variety of outcomes on a particular event, whether it’s a sport, a political event or whatever else it might be. With the right bet and the right outcome, this can be a really effective way to make some money, and it is best done with the attitude of it being an investment rather than a bet – as this helps in keeping things a little more sensible.

To make the right decisions, it is helpful to be patient and work out what kinds of results are likely to occur, and to find them at a good price. Searching for NHL picks and horse racing tips is a good place to start for that. However it might be done, with care and attention this can prove to be a decent way to invest some spare money, so it is definitely something to think about.

Bonds

If you are particularly keen for a very safe form of investment, it is well worth looking into bonds. Bonds are something like a savings account, but with an important difference that needs to be understood well in order to make good use of them. Essentially, you buy a bond and you will be paid back your initial investment, plus any interest that may have accrued along the way too. They are very low-risk and yet can bring you a lot of money over the long-term, so they are worth looking into for pretty much anyone looking to make a little money on the side.

Bear in mind that you won’t be able to access the money during the fixed rate period, so you should only invest whatever you don’t need to have immediate access to. However, they offer higher interest rates than your average savings account, so it can be worth it.

Precious Metals

Another form of investment that many people around the world are investing in right now is precious metals. In truth, these are always popular, and it’s not too hard to appreciate why. After all, precious metals will generally always retain their value even when everything else in the world is going through turmoil. That is especially true of gold, which still holds the standard that the global economy works by – with the exception of cryptocurrency.

As you can see, precious metals are almost certainly worth considering at the very least if you want to invest your money wisely. But make sure that you are only putting what you can afford to lose into this investment, like any other. Although it is not the highest-risk investment, it is not zero-risk either.

Those are just some of the most popular investments around the world that people are making good use of right now. Any of these could be lucrative and useful for you, so take a look at them in turn and see whether any of them are suitable for your needs and purposes. You might be surprised at how effective they can be.

-

Travel12 months ago

Travel12 months agoEnjoy a luxury holiday in Zanzibar

-

Culture and Lifestyle11 months ago

Culture and Lifestyle11 months agoDo you want to surprise a special someone?

-

Business6 months ago

Business6 months agoHow To Future-Proof Your Business With The Right Tools

-

Travel5 months ago

Travel5 months agoTravelling from San Antonio to Guadalajara

-

Business11 months ago

Business11 months agoServiceNow Development Consultancy: Business Process Automation as Disruptive Technology

-

Environment11 months ago

Environment11 months agoThe Future of Fashion: The Rise of Eco-Conscious Brands in the Luxury Market

-

Business9 months ago

Business9 months agoThe importance of telescopic handlers: innovation and efficiency in load handling

-

Travel10 months ago

Travel10 months agoDiscover extraordinary places and enjoy unique experiences