Business

Indian Companies Increasing Foreign Acquisitions; More Companies "Indianized"

|

| Photo by IANS |

Indian companies have become matured, while tough competition remains within the domestic market of the country, Indian companies are exploring more markets and adding more dimensions of competition. In the last decade we saw growing number of acquisitions by Indian company not only of smaller brands but also of much bigger and prestigious brands. In our previous article we discussed how the former colony India has been acquiring more businesses in the UK and “Indianizing” them, becoming the largest employer in the private sector of the UK. It is observed that Indian companies in a collective manner targeted UK businesses more actively, it could be unintentionally or may be some kind of nationalism. Indian companies are now equally active in the rest of the geography in the race to secure resources and technology.

Year 2003. In the year of 2003, one of the key Korean based commercial vehicle company, Daewoo was acquired by Tata Motors. Daewoo was famous for the cars Cielo and Matiz. After the acquisition Daewoo cars disappeared from Indian markets. Today Tata Daewoo is in the heavy vehicle business with its manufacturing and assembly mainly in Korea, India and Pakistan (Afzal Motors).

Year 2005. The confidence in the management of the Tata boosted so high that one by one it acquired more companies in US, South Africa and East Europe making it world’s second largest branded tea maker. US herbal and green tea brand Good Earth was bought by Tata Global Beverages in 2005.

In another move in the automobile industry Tata Motors bought one of the largest manufacturer of bus and coach cabins in Europe, Hispano Motors Carrocera in 2005. Apart from their main plant in Zaragoza, Hispano also has another facility across the Mediterranean sea in Africa, Casablanca, Morocco. Their combined capacity is to produce nearly 2.000 unites per year. With this acquisition Tata also brought a number of jobs by bringing manufacturing of Hispano bodied buses in India at ACGL plant in Goa. These buses are known as Tata Divo.

|

| Why doesn’t Tata launch these buses in India? Variant of Tata Hispano Globus can be seen plying on the airports which lack functioning aerodrome facilities. Photo by Motor India |

Later, in the same year Tata made another acquisition in the UK. UK-based Brunner Mond group and US-based General Chemical Industrial Products were back to back bought by Tata Chemicals.

Year 2006. Another US based beverages firm Eight O’ Clock Coffee was bought for US$220 million. Tata also successfully established itself in the tea markets of other small countries like Czech Republic, where it owns JEMČA which is the biggest selling tea brand in the country.

In a move to secure resources around the world, Indian companies are actively spreading their arms. A study by Ernst and Young reports that the Indian companies have advanced in recent years and have invested appreciably in securing mineral resources. For the first time, in the year 2010, India-based companies scored over Chinese counterparts in the acquisition of foreign mineral assets. To support the statement, Indian companies had invested US$4.64 billion in 2010 to acquire businesses outside India, while Chinese overseas investments declined by more than half to US$4.45 billion.

Year 2007. Tata, just after one year of making its dominating presence in the tea markets of US and UK, moved on to the next big thing, Steel! In the year 2007, ambitious Tata Steels bought a company five times bigger than itself for US$12.1 billion. At that time Corus was ranked eighth largest in the world. This pushed Tata Steel from 65th position in the world steel production to a comfortable 5th position. In an another move in the metallurgy industry by another Indian company, Aditya Birla Group acquired Canadian Novelis, an aluminum producing company, for around $6 billion by its flagship company Hindalco Industries. This acquisition has made Hindalco world’s leading aluminium rolled products producer.

Year 2008. India made notable acquisitions in the sector in which it is considered the world leader, IT sector. Indian company HCL acquired UK based enterprise solution provider Axon in mid 2008. Overall Axon group and its subsidiaries has constituted 14% of HCL Tech’s revenue of Rs 16,030 crore and net profit of Rs 1,646.5 crore proving impressively beneficial. HCL, Infosys, and Tata Consultancy Services have till date acquired large number of companies or established their centres around the world and maintain world dominance when it comes to IT.

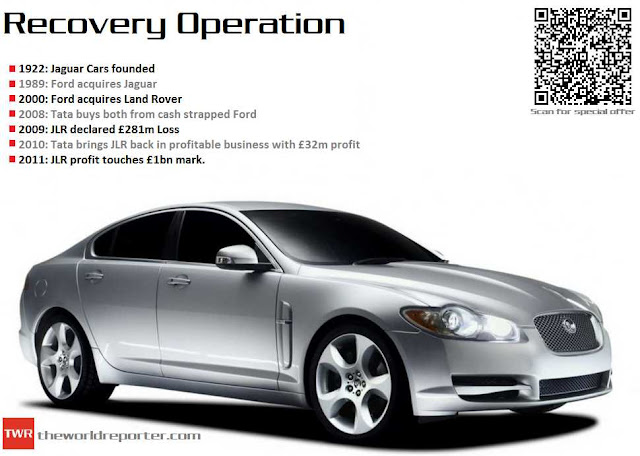

In the same year, in one of the most surprising deal Tata Motor’s acquired prestigious British Jaguar and Land Rover auto brands. Still very few are aware that Tata Motors owns these super luxurious British automobile brands since 2008. Tata never renamed it as Tata Jaguar. Buying from the cash strapped Ford, Tata has now recorded massive net profit in JLR section.

Year 2009. When most of the Indian private companies were surprising the world with one after the other big acquisitions, state run Oil and Natural Gas Corporation (ONGC) also expanded its arm, and this time again it was UK! In January 2009, ONGC bought U.K. firm Imperial Energy for $2.1 billion. It was one of the biggest foreign acquisitions by ONGC Videsh (OVL), which is the overseas arm of ONGC. OVL successfully holds stakes in various parts of the world, notably the Gulf, Latin american and Siberia.

Year 2010. In mid 2010, In one of the largest coal mines deals by an Indian group, Adani Enterprises, in a cash and royalty deal, acquired the Australian coal assets of Linc Energy for US$2.7 billion.

In the same year, Bharati Airtel, India’s largest telco also became world’s fifth largest telecom company after acquiring African assets of Kuwait’s Mobile Telecommunications Co., Zain. Apart from its massive Indian subscribers, this deal provided Bharati Airtel additional 180 million customers in 18 countries and annual revenue of $12.4 billion

Flowing in the spirit, Sahara India Pariwar in late 2010 controversially bought iconic Grosvenor House hotel in London for 470 million pounds (around Rs 3,250 crore), which gave it a considerable stronghold in the global hospitality business. Sahara India Pariwar had been losing businesses in India, Sahara airways, one of them. Sahara is also known for sponsoring various Indian and Bangladeshi sports team.

Talking about sports, Venky, flagship company of Venkateshwara Hatcheries Group bought Blackburn Rovers, 135-year old English premier division football club which however could not keep club’s fans happy.

Pedro Moreno de los Ríos, partner at Parangon Partners explains “One of the great advantages of Indian executives, compared with their Chinese counterparts, is their knowledge of Anglo-American culture. Another advantage is the greater openness that India has enjoyed when it comes to foreign capital”. He further added, “Indian managers tend to have an international approach, and “India is [even] exporting managers to China.”

Peter Cappelli, George W. Taylor Professor of Management at The Wharton School and Director of Wharton’s Center for Human Resources says, “They [Indian Companies] are aware that there are markets that have not been exploited, and they want to take advantage of them, but not if foreigners get one hundred percent of the profits,” explains Peters. He further adds, “That way, they guarantee that India will not be sold off to foreigners.” He says India and Indian companies are giving more important to their development and are open to foreign companies to gain expertise, technology and funding while maintaining control. “India wants to create its own companies and brands, while China leaves the road wide open to foreign companies,” says Peters.

India, which is third largest economy in terms of GDP (PPP) knows that it needs a stable economy if it is dreaming of becoming a super power in every manner. A strong economy, jobs, education, food security and political stability will help India excel in the path which it has already chosen. A number of foreign acquisitions like these have helped Indian companies gain expertise, technology and management lessons which will help this country shape even more global brands in the future. Companies like Tata, Birla, Reliance and Jaypee are also determined to structure better education in India through their state of the art institutions of technology. Foreign acquisition did bring some jobs to India and more importantly India has secured and has been securing some of the key resources field around the world, that will keep feeding its giant economy in a long run.

Business

How To Future-Proof Your Business With The Right Tools

Running a business is a balancing act between managing today’s tasks and planning for tomorrow’s challenges – and getting that balance right is where you’ll find success. Future-proofing your business might sound like something from a sci-fi show or just one of those words that no one really understands or does, but in this case, it’s a real thing, and it’s a really important thing. You’ve got to be proactive, and the tools and systems you choose now can either set you up for long-term success, or leave you in your competitors’ dust, so you’ve got to get it right. With that in mind, keep reading to find out more.

Think Scalability

The tools you’re using right now might seem – and actually be, in fact – perfect for your current needs, but the question isn’t whether they’re working now (you wouldn’t be using them if they weren’t), but instead it’s whether they can grow with you. In other words, you’ve got to choose tools that won’t fall apart as your business grows, meaning you’ve got to start from scratch with new systems – when you’re growing your business, you’ll have enough on your plate without that as well.

For example, small businesses often rely on simple payment methods in the early days, and although they’re definitely convenient, as time goes on you’ll probably have to rethink things, especially if you’re growing. If you’re still relying on quick fixes, it’s probably time to stop using Zelle for payments because when it comes to business transactions, it doesn’t have the features and security of something more professional.

Automate Where You Can

What’s one of the most precious resources any business owner can have? The answer is time. So if time is so precious, why are you wasting it on repetitive tasks when you could be doing other things if you put some automation in place? Just think of all the time you’d free up if you automated your invoicing, social media posts, email campaigns, and so on – what could you do to make your business better with the time you save?

Not only does automation save time, but it also means there’s a lot less chance for human error to creep in, and that’s got to give any business owner lots of peace of mind and reduce their stress levels – and doing that is always a positive.

Stay Ahead On Cybersecurity

You might have noticed a few (and possibly the numbers are growing) headlines recently about big data breaches – it basically means that customers’ sensitive data has been accessed by hackers, and when that happens, those customers can have issues with identity theft, lost money, compromised passwords, and more.

That’s why it’s so important to invest in good cybersecurity if you want to future-proof your business and make it strong and trustworthy today. Strong firewalls, secure payment systems, data encryption, cloud storage, and good cybersecurity training for your team can go a long way to protecting your business and your customers, meaning it’s going to last a lot longer and get a good reputation too.

Business

What are EDC products, and why should you always have them?

EDC gear includes products that have become indispensable for improving one’s quality of life. These are the tools and implements that can solve everything from simple daily tasks to being vital objects capable of saving lives.

Regardless of the lifestyle you lead, there are countless situations in daily life where you need a tool or item that helps resolve inconveniences or facilitates completing tasks. This is where the category of products known as EDC (Every Day Carry) comes into play. EDC includes a variety of items that are necessary in unexpected moments.

For these tools to truly be useful in daily life, they must be durable and of high quality. For this reason, it is highly recommended to choose selected EDC gear by Onibai.com, an Italian brand with extensive experience in selling this kind of exclusive everyday carry equipment. The brand offers a wide selection of well-crafted, durable products that meet the demands of everyday carry needs.

Knives: essential for multiple situations

Knives, or EDC blades, are among the most essential tools in any EDC kit. In fact, they are often seen as a symbol of someone who is prepared, practical, and functional. Whether it’s opening packages or envelopes, cutting cords or ropes, or other simple daily tasks, a suitable knife can make these activities much easier. Additionally, a good knife can serve as a means of self-defence in case of sudden attacks.

Over time, the design of knives has evolved and diversified. Daily-use knives are now specifically designed for lighter cutting tasks, such as those mentioned earlier. Tactical knives, on the other hand, are made for more intense scenarios. They are stronger and reinforced, often designed for high resistance or self-defence situations.

Urban knives, tailored for city dwellers, are built to meet the needs of individuals in modern environments, so they often feature sleek finishes that complement contemporary lifestyles. Another popular category is multi-tool knives, which are designed to handle a variety of tasks. These knives have the resilience and sturdiness of a 3-inch blade while also fulfilling the precision requirements needed for various EDC tasks.

Other essential EDC products

In addition to knives, there is a wide range of other EDC products that are indispensable in daily life. One of these is, undoubtedly, a reliable wallet. A well-designed wallet needs to be robust enough to withstand daily use while keeping essential items like bank cards, identification documents, and more, safe and in good condition.

Flashlights are also vital components of any EDC kit. These tools are incredibly useful in many situations, particularly in dark environments or emergencies where additional lighting is critical. When selecting a torch, factors such as battery life, size, portability, and brightness should all be taken into account.

Purses, fanny packs, or backpacks also play an essential role in everyday carry. These items are where people store the various EDC products described above. They usually come with several compartments and are available in different sizes and materials, depending on the person’s style and daily activities.

Other items that are part of an EDC kit include beads and cords, Velcro patches, bottle openers, multi-functional key organisers, as well as durable, long-lasting, and stylish pens that adapt to any situation and lifestyle.

An interesting category of EDC products includes stress-relief toys for adults, which provide a means of alleviating daily stress. Popular options in this category include fidget spinners, fidget sticks, stress-relief sliders, poker chips with buttons, and mechanical coins. These items not only serve as a source of relaxation but can also be a fun and effective way to manage anxiety and tension during the course of a busy day.

In conclusion, EDC gear is not just a set of tools but a lifestyle that reflects preparedness, practicality, and a proactive approach to the uncertainties of everyday life. The more equipped you are, the more empowered you will feel in facing the challenges that arise.

Business

The importance of telescopic handlers: innovation and efficiency in load handling

In the field of logistics, efficiency and safety are key aspects for the success of any project. Machines and tools must handle heavy loads and perform complex tasks with precision. In this sense, Magni TH telescopic handlers are the perfect option.

Telescopic handlers are lifting equipment that combine the capabilities of a crane and a forklift, featuring a telescopic arm that can extend and retract to reach considerable heights and access areas that may be difficult to reach manually. Thanks to this versatility, they become essential tools for a wide range of applications, indispensable in multiple sectors.

Today, the telescopic handler industry is constantly evolving, with technological innovations that enhance their functionality. One of the leading companies in this field is Magni TH, renowned for offering high-quality, efficient machinery with a focus on innovation and sustainability. This ensures that their telescopic handlers not only meet current demands but are also prepared for future challenges.

What does Magni TH offer?

Magni TH stands out in the market by offering a wide range of telescopic handlers that adapt to a long list of specific needs. Among their most notable models are fixed telescopic handlers (TH), rotating telescopic handlers (RTH), and heavy-duty telescopic handlers (HTH). They also offer aerial platforms, ranging from fixed models to articulated and rotating versions.

Furthermore, Magni TH machinery is widely recognised for its high-quality standards, due in large part to the selection of top-class raw materials. This attention to detail not only ensures compliance with market safety standards but exceeds them, guaranteeing that every machine is 100% reliable and durable.

Magni TH’s manufacturing process is another aspect that sets them apart. The company combines advanced industrial techniques with a craftsmanship approach, allowing for continuous innovation and enabling them to remain at the forefront of the market. This combined approach not only improves production efficiency but also allows for greater customisation.

In addition to their impressive product line, Magni TH is committed to providing proper advice and training to its customers. The company offers detailed descriptions of its products and services, ensuring that customers fully understand the capabilities and strengths of each machine model.

Magni TH also stands out for its focus on sustainability, reflected in the energy efficiency of each of their machines. This not only maximises user productivity but also ensures environmental responsibility at all times.

Innovation and safety

The use of innovative, high-quality telescopic handlers, like those manufactured by Magni TH, is essential for significantly improving operational efficiency across various sectors. These machines, thanks to their precision and speed in executing complex tasks, help reduce the time needed to complete projects, thereby increasing the overall productivity of companies.

On the other hand, safety is another key aspect when using high-quality telescopic handlers. These machines are equipped with advanced safety systems, such as stabilisers, enclosed cabins to protect operators, and load control systems, ensuring operations are carried out efficiently and reliably. Moreover, their ability to handle loads with precision and care is crucial for ensuring the integrity of products, significantly reducing the risk of damage during transport and handling. This is particularly important in sectors where product integrity is critical to maintaining high-quality standards.

At the same time, the use of innovative telescopic handlers can also enhance a company’s competitiveness. Investing in high-quality equipment allows them to provide services with greater efficiency and safety, helping them stand out in the market. Ultimately, investing in this type of telescopic handler can be considered a strategic decision that can have positive long-term impacts on the sustainability and growth of a company, as adopting advanced technologies demonstrates a commitment to excellence and proactivity, keeping companies at the forefront and allowing them to adapt easily to the many changes in the market.

Versatile Applications of Magni TH

Magni TH telescopic handlers are known for their versatility and ability to adapt to a wide range of applications. Unlike other companies that focus on specific sectors, Magni TH offers its products to any industry that requires load handling solutions. For example, in the agricultural sector, Magni TH telescopic handlers are key tools for tasks such as handling hay bales, transporting fertilisers, and loading livestock. Additionally, their ability to navigate uneven terrain and lift large volumes of material are essential advantages on farms and agricultural operations.

Likewise, the maritime sector benefits greatly from the versatility of Magni TH telescopic handlers. These machines are ideal for storage and cargo handling on vessels and ports, as well as for small routine maintenance operations.

In construction, Magni TH telescopic handlers are one of the most widely used tools, enabling the lifting and positioning of heavy materials such as bricks, cement, and beams. Regardless of the size of the construction project, their ability to operate on difficult terrain and reach high altitudes makes them ideal for any occasion, improving productivity and minimising the risk of accidents.

Finally, telescopic handlers are also widely useful in the industrial and mining sectors. In industry, these machines are employed for material handling in factories and warehouses, while in mining, their robustness, and load capacity make them a perfect option for working in extreme conditions.

-

Business8 months ago

Business8 months agoHow To Future-Proof Your Business With The Right Tools

-

Travel7 months ago

Travel7 months agoTravelling from San Antonio to Guadalajara

-

Business11 months ago

Business11 months agoThe importance of telescopic handlers: innovation and efficiency in load handling

-

Travel12 months ago

Travel12 months agoDiscover extraordinary places and enjoy unique experiences

-

Business10 months ago

Business10 months agoWhat are EDC products, and why should you always have them?

-

Travel4 months ago

Travel4 months agoTravel wellness tips for a healthier and more enjoyable journey

-

Europe2 months ago

Europe2 months agoRecent Books by Boaventura de Sousa Santos: Law, Colonialism, and the Future of Europe