flickr/royluck

Nowadays, the problem of energy efficiency and energy saving stands in the forefront of the global agenda. Each of us is engaged in the process of conserving resources. We save electricity by installing high-efficient LED lamps, power production companies purchase new generation equipment in order to increase the coefficient of performance of the plants and engineers are continuously working to make fuel consumption in our cars more effective. However, have you ever thought how much of these natural resources is wasted without any use? In this article I will try to cover the problem of associated petroleum gas flaring.

I am sure everyone knows that natural gas is one of the major energy sources. Associated petroleum gas (APG), or associated gas, is a form of natural gas as well. It is found with deposits of petroleum, either dissolved in the oil or as a free “gas cap” above the oil in the reservoir under high pressure reservoir conditions (1). When oil is extracted, the pressure decreases and associated gas separates from the oil. However, traditionally this gas is considered as a waste product and is simply burnt off in gas flares. This process is called flaring and when it occurs this gas is referred to as flare gas. Taking example of Russia, which is one of the largest producer of oil and gas in the world, currently for each tonne of oil produced in Russia about 150 cubic metre of associated gas is released and this value is rising each year (2). This situation can be explained by the fact that oil production in Russia is moving to the east and north of the country. In such regions average gas/oil ratio is higher than in traditional production regions and can reach several hundred cubic meters per tonne of oil.

However, not all amount of APG is flared. Major share, that is 60% approximately, is sent from the oil field to gas processing plants and to other consumers. APG is usually separated to stripped gas (methane, or general natural gas) and NGL (natural gas liquids, which commonly consist of propane, butane and other heavy gas fractions). Further, natural gas can be used for wide range of needs, while NGL is commonly used as a raw material in chemical industry.

In Russia NGL is usually purchased by chemical companies for polyethylene and polypropylene production. 22% Of associated gas is used for oil field’s own needs, that includes utilizing APG for electricity and heat generation in steam or gas turbine power plants, and pumping APG to the reservoir in order to support extraction pressure. Also, associated gas can be used for synthetic fuel production on site via GTL (Gas-To-Liquid) conversion, however, there is almost no experience of this method application in Russia so far. Finally, 17% of APG is flared, and losses accounts for remaining 1% (2).

It should be taken into the consideration, that these figures are average among Russia and regions around it. In some states APG efficient use is almost equal to 100%, while in others it barely exceeds 50% (3). Low APG utilization levels are observed in the oil fields that are situated in remote underpopulated areas with severe climate and weather conditions. In such regions APG transporting from the field is very expensive and does not pay back. The use of associated gas for oil field’s own needs is limited. The main problem is that APG extraction is not constant, its variation is significant during the project lifetime, and coefficient of performance and other parameters of power plants are usually low at part loads. Furthermore, expensive gas pre-treatment facility must be installed in order to purify APG from sulphur, nitrogen and other harmful compounds. Such investment also can be unsustainable for medium and small scale oil production facilities. So, these factors causes flaring of significant APG amount without any use.

It is worth noting, that today efficient associated petroleum gas utilization level is rising every year in the country (2). Nevertheless, Russian Federation still takes the first place in the world in terms of gas flaring according to Worldbank. Each year Russian oil extraction industry flares up to 17 billion cubic meters of APG according to official Russian statistics (2). In order to show you how significant this value is, I would like to note that this can be compared to annual natural gas consumption of a typical European country. However, Worldbank estimates total gas flaring in Russia (what is mainly associated gas flaring) at much higher value: 35 billion cubic meters annually (4).

Associated gas flaring is not only a huge resource waste. It causes water, soil, air, and thermal pollution in the neighbourhood. When APG is utilized at flare facility about 10% of its value is vented directly into the atmosphere. As methane (the major component of APG) has global warming potential (GWP) coefficient 21 times more than CO2 (5), such 10% vented volume accounts for greenhouse gas emissions equivalent to CO2 emissions from remaining 90% of APG burned completely. On the basis of official Russian statistics on APG flaring in 2014, it can be estimated that flaring in Russia accounts for 30 million tonnes of annual CO2 emissions. This value can be compared to the total CO2 emissions generated annually by an entire European country such as Sweden or Norway. Among the emissions, apart from methane leaks and CO2, harmful components such as sulphur, nitrogen oxides, carbon monoxide, soot, benzyl, phosgene, toluene, heavy metals (mercury, arsenic, chrome), sulphuric anhydrite, and others are also present (6).

But how can we deal with such enormous resource waste? Is there any possibility to avoid loosing precious natural resource?

Firstly, I would like to discuss current situation in oil and gas production in Russia. Today as I already noticed oil and gas production shifts to the north and east of the country, to Western Siberia and Far East, and new exploration fields are mainly medium or small. Traditionally, such oil fields are supplied with energy from diesel generators. However, the fuel is usually very hard to deliver in remote areas. For example, in many regions helicopter is the only one mean of transportation. Hence, diesel fuel cost rises up to several times during the delivery process. This situation calls for the need of reliable energy generation methods using available local fuels. In this respect, APG would be a very attractive source of energy.

If we take into account high gas-oil ratio in new exploration regions, it turns out that electricity production from APG from turbines exceed power consumption value by several times. Such energy excess is hard to utilize in remote areas. Moreover, this methods does not solve the problem of fuel supply for vehicles that are working continuously on the field. Good option could be the use of associated gas partly for electricity production and partly for other needs. After conducting analysis of different APG utilization methods, it was concluded, that GTL conversion plant can be good solution for effective associated gas utilization in remote areas on small and medium scale facilities. What is special about GTL method is the possibility to use heat of the conversion reaction to produce electricity, which covers own needs of the plant and oil field’s as well. Also, significant amount of synthetic liquid hydrocarbons is produced. Part of it can be used for high quality diesel fuel generation which can be further consumed by cars and other vehicles in the oil field. The remaining can be mixed with recovered oil and send to the pipeline. This is very attractive method, don’t you think so? But there has to be catch. Why this solution is not applied at Russian oil fields? The answer is simple: no experience of implementing this technology and high capital and operating investments. Although today modern small scale GTL cost effective technologies have started to appear and surely they will play important role in solving the problem of gas flaring.

I hope that in the future we would utilize finite natural sources more carefully and the term «gas flaring» will remain only as an relic of the past.

1. Glossary of Terms Used in Petroleum Reserves/Resources Definitions. – 14 p. – http://www.spe.org/industry/docs/GlossaryPetroleumReserves-ResourcesDefinitions_2005.pdf.

2. Российский статистический ежегодник 2015. [Russian Statistical Yearbook 2015]. – 728 p. – http://www.gks.ru/free_doc/doc_2015/year/ejegod-15.pdf

3. Регионы России. Социально-экономические показатели. [Regions of Russia. Socio-economic Indicators]. – 1266 p. – http://www.gks.ru/free_doc/doc_2015/region/reg-pok15.pdf.

4. Worldbank. Global Gas Flaring Reduction Partnership (GGFR) Top 20 gas flaring countries. – http://www.worldbank.org/content/dam/Worldbank/Programs/GGFR%20Presentation%20March%202015.pdf

5. Climate Change 1995, The Science of Climate Change: Summary for Policymakers and Technical Summary of the Working Group I Report. – 572 p. – https://www.ipcc.ch/ipccreports/sar/wg_I/ipcc_sar_wg_I_full_report.pdf.

6. Попутный нефтяной газ в России: «Сжигать нельзя, перерабатывать!» [Associated Petroleum Gas in Russia: «Do not Flare, Utilize!»]. – 88 p. – https://www.wwf.ru/data/pub/oil/wwf_png_net_corrected.pdf.

Economy

Protecting Your Business From Rising Fuel Costs

The cost of fuel is soaring globally, due to various factors, including the coronavirus pandemic and the ongoing conflict in Ukraine.

Businesses everywhere are feeling the burden that comes with increased energy costs. However, there are a number of things that experts have determined companies can do to fight back and protect their businesses from rising fuel costs.

Implement green measures

Dusistainbility has been a big trend in global business in recent years. Companies that have not yet embraced measures such as the paperless office and the use of solar power, many find that doing so now could help to offset some of the extra costs arising due to higher gas, oil, and electricity prices.

A four-day week

The benefits of a four-day week for employers and their employees have long been debated, but there is a lot of evidence to suggest that companies can be run just as efficiently in four days as they can in five. This could give companies struggling with the cost of heating, and lighting their offices, or running their machinery the opportunity they need to protect their business from fuel costs without losing money.

Should a factory, for example, close for one extra day per week, they would save 20 percent of its operating costs, and studies have shown that employees who work four days a week are around 20 percent more productive, which means they could save a great deal on the ongoing cost of fuel, without ruining their productivity or losing revenue. Many experts believe this to be a win-win situation.

Special offers

Of course, when the price of fuel rises, in certain industries, customers may be affected by those costs, and therefore less likely to make the same level of purchases they once did. Companies who find themselves in this position need to do whatever they can to encourage customers to buy.

For example, Volvo Penta, which sell luxury yacht and marine engines, among other applications, may find that due to the cost of fueling a vessel, fewer people are going out o their boats, causing sales to drop. By making special offers or putting together attractive packages, they can encourage more purchases to be made. If the product is good, and the price is right, it is easier to weather this particular storm.

Downsizing

Now that remote working is easier than ever, downsizing office space is set to be another important way that companies around the world can protect themselves from the rising cost of fuel. The fewer employees who need to be in the office or onsite, the smaller the office space can be, and the fewer resources will be required to keep it running smoothly, so expect to see more homeworking going forward.

The cost of fuel may be set to rise even further in the Autumn, and no one knows exactly what will happen beyond that, but there are a number of things businesses can do in mitigation, so it is almost certainly not time to panic yet.

Economy

Joao Vale e Azevedo: pessimistic prospects could be tackled by collectivity

As we enter the new year, the effects of 2021 are now echoing in the economy in 2022. According to the World Bank’s latest Global Economic Prospects report, global growth is expected to decelerate markedly from 5.5 in 2021 to 4.1 in 2002 and 3.2 percent in 2023. This has been proposed both in the case of developing and major economies, such as the case of the United States.

In 2021, governments around the world have suggested that it was a year of rebirth. However, current numbers are not showing that and so not everyone is trusting on this bet. This is the case of Joao Vale e Azevedo, chairman of KUNST Global – an equity firm based in London, Geneva, Zurich and Luxembourg. For him, the forecast is still negative for 2022 as inflation keeps on running critically in the US and in many European countries. But unlike in the 1970s and 1980s, the solution won’t lie in governments printing money like they did in the past.

The chairman of KUNST Global also doesn’t think that the so-called commodity crisis is temporary as the news might say. In fact, Azevedo believes that there is more to it than the effects of the pandemic. While the Covid-19 crisis has ignited the growth of e-commerce, Azevedo claims that this intensification in demand for goods would happen anyway and the problem is actually in the distribution industry: “It is unable to meet this increased demand. There is no labor, no trucks, nor ships. The offer is no longer able to meet the market demand and this is not a contingency, it is a physiological fact.”

Finally, the third and possibly the most concerning problem is the price of energy. “This is really a worrying question, and not only for our distant future, as it has been up to now, but also for our present,” explains Azevedo. “We are witnessing it on a daily basis: electricity and gas bills have skyrocketed. Families and companies, which were already suffering from the pandemic, do not know how to cope with the increases.”

Although propositions like moving from coal to gas or from oil to electricity may point the way out, Azevedo thinks we are completely deprived of the infrastructure and funds necessary to manage this change. What is more, the chairman of KUNST Global argues that present politics lacks long-term vision, which means politicians are often too focused on electoral cycles instead of considering the future – thus mining any possibility of investments for change.

In addition to that, Azevedo has been keeping a close eye on the war in Ukraine. In his opinion, if Russia persists in carrying on the war, not only this country will be doomed to bankruptcy, but the whole West could face a domino effect. “Regardless of this, the war in Ukraine means greater market instability, rising energy prices that are already out of control, and a further increase in inflation, which could reach double the current levels,” he adds.

However, not all hope is lost. Hopefully, the war in Ukraine will find a rapid resolution, which is something that could catalyze even more this sense of collectivity that Joao Vale e Azevedo sees growing after two years of pandemic. “The fact that we have had fewer opportunities for interaction has meant that we are now more aware of the value of those interactions, and probably also of human life. We are a stronger community. The challenges that await us are very difficult, but together we are much better prepared to face them,” he concludes.

Economy

How People Around The World Are Investing Their Money

One thing that everyone should aim to do with their spare cash is to invest it – as wisely as possible, but at least in a way which is going to lead to potentially high returns. If done correctly and with a bit of good fortune, it is perfectly easy to improve one’s wealth to a considerable degree this way, and it is therefore well worth people considering this.

As it happens, there are a lot of investment options that people are making use of all over the world, with some that are especially popular right now. Let’s take a look in some detail at some of the major ways in which people are investing their money – and making some considerable gains, in many cases.

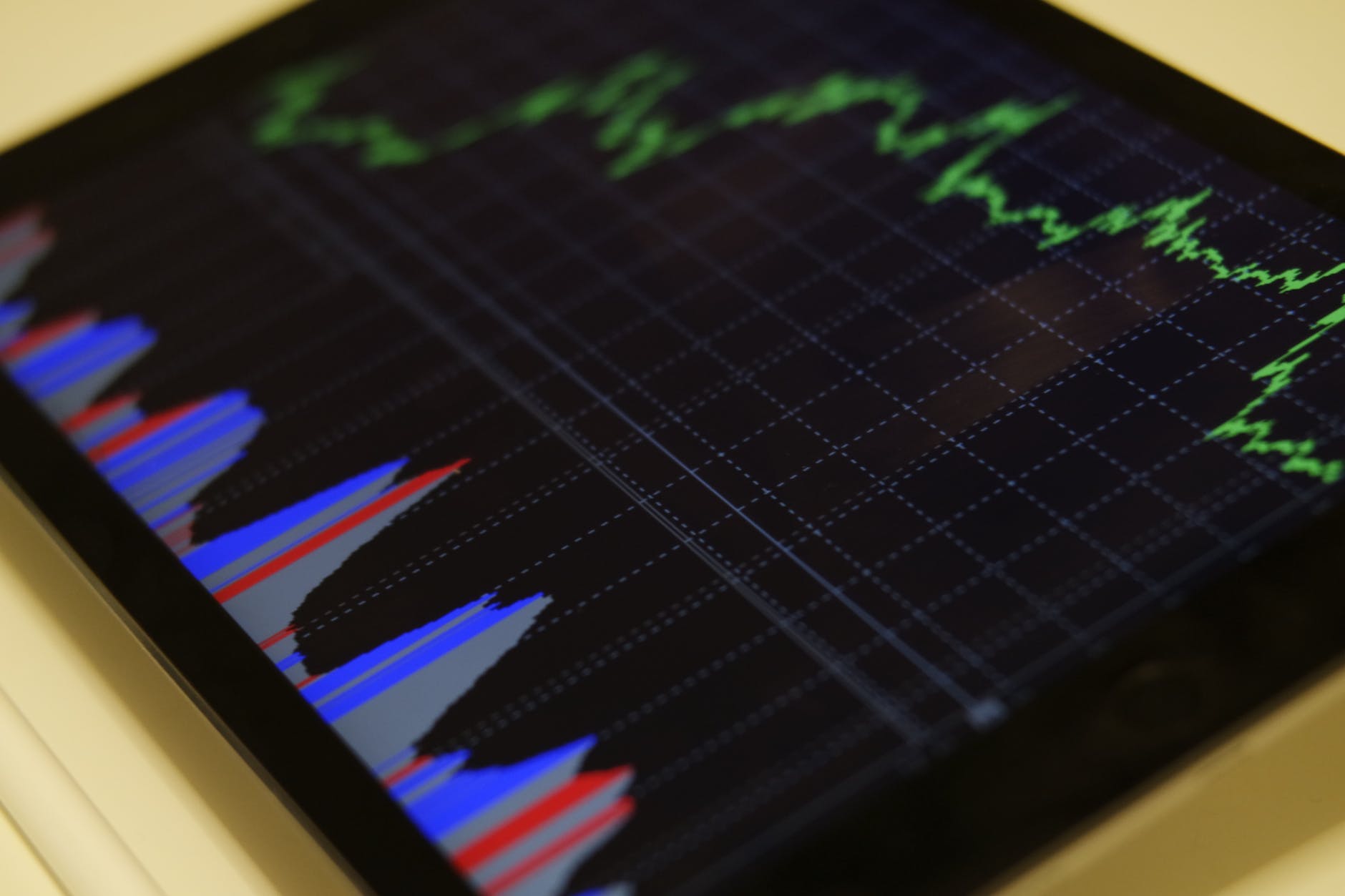

Stocks & Shares

Arguably one of the most popular forms of investment is stocks and shares – which can be incredibly lucrative if it is done in the right way, and with the right set of circumstances behind an investment. Indeed, stocks and shares remain the number one investment that people are engaging in every day throughout the world, and with good reason. Not only is it potentially something that can bring considerable returns, it is also relatively straightforward to get into and learn at least the basics of, making it a very simple and easy form of investment for most people.

It also doesn’t require a huge amount of money to get going – although having that is obviously not going to hurt one’s chances of success starting out! In fact, it’s doable to get going with stocks and shares with literally a few spare pennies – so it really is something that pretty much anyone can get into and make use of. It can also be a good way to diversify and widen out a portfolio that may include other forms of investment as well.

Savings Accounts

Although many people think of investment and savings as two different things, they are really just two sides of the same coin. You can think of saving as a form of investment, especially if it is done in the right manner and with the right approach. Of course, in order to find success with this, it is important to make sure that you are choosing the best savings account there is. That means one that has a high enough interest rate for it to be worth it, as well as having other functions that might be important to an individual – such as the ability to take money out whenever you need to, for instance.

With interest rates diving all over the world, this is quickly becoming one of the less popular forms of investment – but for now it is still worth considering, as it can be a good way to at least store your spare cash as necessary. If nothing else, you’ll probably find that you are able to find yourself in a much better financial position this way soon enough, even if that doesn’t happen as quickly as it might with certain other investments.

Cryptocurrencies

Although there is some controversy around cryptocurrencies, there is no doubt that it is one of the world’s most popular forms of investment right now. There is also no doubt that it’s possible to make a lot of money this way – as some of the world’s richest people have done so already. Even in a much lesser sense, however, it is perfectly possible for an individual with a regular amount of wealth to make money investing in cryptocurrencies. And generally, this is done in a few key ways.

First of all, you can simply buy some crypto and then hold on to it, hoping for its value to improve and selling it on once it has done so. Alternatively, you might want to consider trading crypto coins by buying one kind and then trading into another as you think it might be lucrative. This takes a bit more knowledge, patience and skill, but the returns can be significant. Either of these can work very well, however, and they are worth thinking about at the very least.

A related form of investment, in that it too relies upon blockchain technology, is NFTs. These pieces of art can be bought and traded as above, and some of them are creating huge amounts of money for people right now, so it might well be worth getting into.

Spread Betting

Another form of investment that a lot of people are getting into in the past few years is something known as spread betting. This is where you place bets on a variety of outcomes on a particular event, whether it’s a sport, a political event or whatever else it might be. With the right bet and the right outcome, this can be a really effective way to make some money, and it is best done with the attitude of it being an investment rather than a bet – as this helps in keeping things a little more sensible.

To make the right decisions, it is helpful to be patient and work out what kinds of results are likely to occur, and to find them at a good price. Searching for NHL picks and horse racing tips is a good place to start for that. However it might be done, with care and attention this can prove to be a decent way to invest some spare money, so it is definitely something to think about.

Bonds

If you are particularly keen for a very safe form of investment, it is well worth looking into bonds. Bonds are something like a savings account, but with an important difference that needs to be understood well in order to make good use of them. Essentially, you buy a bond and you will be paid back your initial investment, plus any interest that may have accrued along the way too. They are very low-risk and yet can bring you a lot of money over the long-term, so they are worth looking into for pretty much anyone looking to make a little money on the side.

Bear in mind that you won’t be able to access the money during the fixed rate period, so you should only invest whatever you don’t need to have immediate access to. However, they offer higher interest rates than your average savings account, so it can be worth it.

Precious Metals

Another form of investment that many people around the world are investing in right now is precious metals. In truth, these are always popular, and it’s not too hard to appreciate why. After all, precious metals will generally always retain their value even when everything else in the world is going through turmoil. That is especially true of gold, which still holds the standard that the global economy works by – with the exception of cryptocurrency.

As you can see, precious metals are almost certainly worth considering at the very least if you want to invest your money wisely. But make sure that you are only putting what you can afford to lose into this investment, like any other. Although it is not the highest-risk investment, it is not zero-risk either.

Those are just some of the most popular investments around the world that people are making good use of right now. Any of these could be lucrative and useful for you, so take a look at them in turn and see whether any of them are suitable for your needs and purposes. You might be surprised at how effective they can be.