Business

Knowledge means power

Ever since the early ages, having the right information at the right moment has meant power, and only those who could work their way to get it, were able to enjoy that privilege. Today, the Internet has made a drastic change of things, spreading information throughout the world in a way that everyone who has access to a connected computer, can be easily informed of whatever is going on around the globe in a split-second. This fact has dramatically increased the capacity of every individual to choose and get the most from the information technology aimed for a better living.

Printed news

Recent research points out that back in the year 59 BC, in the city of Rome, a pasquinade was used to keep the citizens informed about the daily actions of the Republic. But it was only until the invention of Guttemberg’s press, that the daily newspapers known today, finally appeared by the end of the 15th century in the form of single printed pages. As time passed by, printed press grew with huge strength, and in the year of 1690, the first newspaper named Public Occurrences, was printed in America on the day of September 25th, by Richard Pierce and edited by Benjamin Harris. It had only three pages.

During the 19th century the newspaper evolved and spread thanks to Otto Mergenthaler who invented the Linotype machine, the first device capable of printing a complete set of lines of type for use in the printing press. Since then, newspapers widely spread around the world until recent years when they are starting to migrate to an online format.

You can download everyday any newspaper in PDF

After the rise of the digital era, newspapers were forced to find out new ways to reach people, actual technology trends have driven big changes in the way daily tasks are done, a mere example is the availability of Internet to mass population. By the year 2007 the number of Internet users was already more than 1 billion, creating a new global landscape for all companies, including those dedicated to daily news of course. The level of information available nowadays represents a summit for journalism, but on the other hand, no one seems to be interested any more on reading from paper.

Opportunities for journalists to report spectacular news have grown exponentially but written media has experienced an awful decline. Since the Internet was launched back in the 90s, many newspapers have been forced to redefine themselves. That is exactly what the most experienced and powerful news companies have done: re-inventing themselves. They have played a crucial role in society for about hundred years until now, and these changes are not going to affect to them.

Studies show that even when fewer newspapers roll off the presses, that nightly network news are currently seen by less than half the people that used to watch them every night, and that news magazines are no longer what they used to be a generation ago, the news industry has found resources to feed from in digital media. You can now download every day newspaper in PDF and keep on enjoying the same outstanding information from the Starledger that used to be delivered to your family’s doorstep during your younger days, on a more convenient digital format now!

Gain back your access to the real stuff!

The Internet has replaced television and radio when it comes to breaking news immediacy. On the web, you can easily gain access to blogs of all kinds that provide endless analysis and opinions on whatever trends or news are on fire today, newsletters from sources of all kinds, videos of all sorts and countless other ways of getting information but, only by tracking down your own steps back to what you have known all your life as real and professional, is how you will seriously be informed with real free opinions and outstanding armchair analysis about your true interests.

This is why traditional newspapers have migrated to the net and you can now download every day newspaper in pdf, and read comfortably the New York Times just the way you have always liked, peacefully at home, at the time of your preference with the total confidence that what you are reading is trustworthy.

Business

How To Future-Proof Your Business With The Right Tools

Running a business is a balancing act between managing today’s tasks and planning for tomorrow’s challenges – and getting that balance right is where you’ll find success. Future-proofing your business might sound like something from a sci-fi show or just one of those words that no one really understands or does, but in this case, it’s a real thing, and it’s a really important thing. You’ve got to be proactive, and the tools and systems you choose now can either set you up for long-term success, or leave you in your competitors’ dust, so you’ve got to get it right. With that in mind, keep reading to find out more.

Think Scalability

The tools you’re using right now might seem – and actually be, in fact – perfect for your current needs, but the question isn’t whether they’re working now (you wouldn’t be using them if they weren’t), but instead it’s whether they can grow with you. In other words, you’ve got to choose tools that won’t fall apart as your business grows, meaning you’ve got to start from scratch with new systems – when you’re growing your business, you’ll have enough on your plate without that as well.

For example, small businesses often rely on simple payment methods in the early days, and although they’re definitely convenient, as time goes on you’ll probably have to rethink things, especially if you’re growing. If you’re still relying on quick fixes, it’s probably time to stop using Zelle for payments because when it comes to business transactions, it doesn’t have the features and security of something more professional.

Automate Where You Can

What’s one of the most precious resources any business owner can have? The answer is time. So if time is so precious, why are you wasting it on repetitive tasks when you could be doing other things if you put some automation in place? Just think of all the time you’d free up if you automated your invoicing, social media posts, email campaigns, and so on – what could you do to make your business better with the time you save?

Not only does automation save time, but it also means there’s a lot less chance for human error to creep in, and that’s got to give any business owner lots of peace of mind and reduce their stress levels – and doing that is always a positive.

Stay Ahead On Cybersecurity

You might have noticed a few (and possibly the numbers are growing) headlines recently about big data breaches – it basically means that customers’ sensitive data has been accessed by hackers, and when that happens, those customers can have issues with identity theft, lost money, compromised passwords, and more.

That’s why it’s so important to invest in good cybersecurity if you want to future-proof your business and make it strong and trustworthy today. Strong firewalls, secure payment systems, data encryption, cloud storage, and good cybersecurity training for your team can go a long way to protecting your business and your customers, meaning it’s going to last a lot longer and get a good reputation too.

Business

What are EDC products, and why should you always have them?

EDC gear includes products that have become indispensable for improving one’s quality of life. These are the tools and implements that can solve everything from simple daily tasks to being vital objects capable of saving lives.

Regardless of the lifestyle you lead, there are countless situations in daily life where you need a tool or item that helps resolve inconveniences or facilitates completing tasks. This is where the category of products known as EDC (Every Day Carry) comes into play. EDC includes a variety of items that are necessary in unexpected moments.

For these tools to truly be useful in daily life, they must be durable and of high quality. For this reason, it is highly recommended to choose selected EDC gear by Onibai.com, an Italian brand with extensive experience in selling this kind of exclusive everyday carry equipment. The brand offers a wide selection of well-crafted, durable products that meet the demands of everyday carry needs.

Knives: essential for multiple situations

Knives, or EDC blades, are among the most essential tools in any EDC kit. In fact, they are often seen as a symbol of someone who is prepared, practical, and functional. Whether it’s opening packages or envelopes, cutting cords or ropes, or other simple daily tasks, a suitable knife can make these activities much easier. Additionally, a good knife can serve as a means of self-defence in case of sudden attacks.

Over time, the design of knives has evolved and diversified. Daily-use knives are now specifically designed for lighter cutting tasks, such as those mentioned earlier. Tactical knives, on the other hand, are made for more intense scenarios. They are stronger and reinforced, often designed for high resistance or self-defence situations.

Urban knives, tailored for city dwellers, are built to meet the needs of individuals in modern environments, so they often feature sleek finishes that complement contemporary lifestyles. Another popular category is multi-tool knives, which are designed to handle a variety of tasks. These knives have the resilience and sturdiness of a 3-inch blade while also fulfilling the precision requirements needed for various EDC tasks.

Other essential EDC products

In addition to knives, there is a wide range of other EDC products that are indispensable in daily life. One of these is, undoubtedly, a reliable wallet. A well-designed wallet needs to be robust enough to withstand daily use while keeping essential items like bank cards, identification documents, and more, safe and in good condition.

Flashlights are also vital components of any EDC kit. These tools are incredibly useful in many situations, particularly in dark environments or emergencies where additional lighting is critical. When selecting a torch, factors such as battery life, size, portability, and brightness should all be taken into account.

Purses, fanny packs, or backpacks also play an essential role in everyday carry. These items are where people store the various EDC products described above. They usually come with several compartments and are available in different sizes and materials, depending on the person’s style and daily activities.

Other items that are part of an EDC kit include beads and cords, Velcro patches, bottle openers, multi-functional key organisers, as well as durable, long-lasting, and stylish pens that adapt to any situation and lifestyle.

An interesting category of EDC products includes stress-relief toys for adults, which provide a means of alleviating daily stress. Popular options in this category include fidget spinners, fidget sticks, stress-relief sliders, poker chips with buttons, and mechanical coins. These items not only serve as a source of relaxation but can also be a fun and effective way to manage anxiety and tension during the course of a busy day.

In conclusion, EDC gear is not just a set of tools but a lifestyle that reflects preparedness, practicality, and a proactive approach to the uncertainties of everyday life. The more equipped you are, the more empowered you will feel in facing the challenges that arise.

Business

The importance of telescopic handlers: innovation and efficiency in load handling

In the field of logistics, efficiency and safety are key aspects for the success of any project. Machines and tools must handle heavy loads and perform complex tasks with precision. In this sense, Magni TH telescopic handlers are the perfect option.

Telescopic handlers are lifting equipment that combine the capabilities of a crane and a forklift, featuring a telescopic arm that can extend and retract to reach considerable heights and access areas that may be difficult to reach manually. Thanks to this versatility, they become essential tools for a wide range of applications, indispensable in multiple sectors.

Today, the telescopic handler industry is constantly evolving, with technological innovations that enhance their functionality. One of the leading companies in this field is Magni TH, renowned for offering high-quality, efficient machinery with a focus on innovation and sustainability. This ensures that their telescopic handlers not only meet current demands but are also prepared for future challenges.

What does Magni TH offer?

Magni TH stands out in the market by offering a wide range of telescopic handlers that adapt to a long list of specific needs. Among their most notable models are fixed telescopic handlers (TH), rotating telescopic handlers (RTH), and heavy-duty telescopic handlers (HTH). They also offer aerial platforms, ranging from fixed models to articulated and rotating versions.

Furthermore, Magni TH machinery is widely recognised for its high-quality standards, due in large part to the selection of top-class raw materials. This attention to detail not only ensures compliance with market safety standards but exceeds them, guaranteeing that every machine is 100% reliable and durable.

Magni TH’s manufacturing process is another aspect that sets them apart. The company combines advanced industrial techniques with a craftsmanship approach, allowing for continuous innovation and enabling them to remain at the forefront of the market. This combined approach not only improves production efficiency but also allows for greater customisation.

In addition to their impressive product line, Magni TH is committed to providing proper advice and training to its customers. The company offers detailed descriptions of its products and services, ensuring that customers fully understand the capabilities and strengths of each machine model.

Magni TH also stands out for its focus on sustainability, reflected in the energy efficiency of each of their machines. This not only maximises user productivity but also ensures environmental responsibility at all times.

Innovation and safety

The use of innovative, high-quality telescopic handlers, like those manufactured by Magni TH, is essential for significantly improving operational efficiency across various sectors. These machines, thanks to their precision and speed in executing complex tasks, help reduce the time needed to complete projects, thereby increasing the overall productivity of companies.

On the other hand, safety is another key aspect when using high-quality telescopic handlers. These machines are equipped with advanced safety systems, such as stabilisers, enclosed cabins to protect operators, and load control systems, ensuring operations are carried out efficiently and reliably. Moreover, their ability to handle loads with precision and care is crucial for ensuring the integrity of products, significantly reducing the risk of damage during transport and handling. This is particularly important in sectors where product integrity is critical to maintaining high-quality standards.

At the same time, the use of innovative telescopic handlers can also enhance a company’s competitiveness. Investing in high-quality equipment allows them to provide services with greater efficiency and safety, helping them stand out in the market. Ultimately, investing in this type of telescopic handler can be considered a strategic decision that can have positive long-term impacts on the sustainability and growth of a company, as adopting advanced technologies demonstrates a commitment to excellence and proactivity, keeping companies at the forefront and allowing them to adapt easily to the many changes in the market.

Versatile Applications of Magni TH

Magni TH telescopic handlers are known for their versatility and ability to adapt to a wide range of applications. Unlike other companies that focus on specific sectors, Magni TH offers its products to any industry that requires load handling solutions. For example, in the agricultural sector, Magni TH telescopic handlers are key tools for tasks such as handling hay bales, transporting fertilisers, and loading livestock. Additionally, their ability to navigate uneven terrain and lift large volumes of material are essential advantages on farms and agricultural operations.

Likewise, the maritime sector benefits greatly from the versatility of Magni TH telescopic handlers. These machines are ideal for storage and cargo handling on vessels and ports, as well as for small routine maintenance operations.

In construction, Magni TH telescopic handlers are one of the most widely used tools, enabling the lifting and positioning of heavy materials such as bricks, cement, and beams. Regardless of the size of the construction project, their ability to operate on difficult terrain and reach high altitudes makes them ideal for any occasion, improving productivity and minimising the risk of accidents.

Finally, telescopic handlers are also widely useful in the industrial and mining sectors. In industry, these machines are employed for material handling in factories and warehouses, while in mining, their robustness, and load capacity make them a perfect option for working in extreme conditions.

-

Business12 months ago

Business12 months agoHow To Future-Proof Your Business With The Right Tools

-

Travel10 months ago

Travel10 months agoTravelling from San Antonio to Guadalajara

-

Travel7 months ago

Travel7 months agoTravel wellness tips for a healthier and more enjoyable journey

-

Europe6 months ago

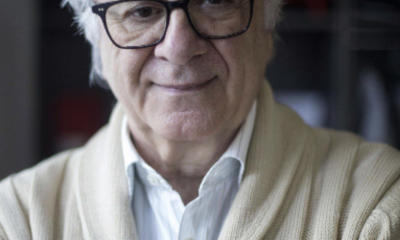

Europe6 months agoRecent Books by Boaventura de Sousa Santos: Law, Colonialism, and the Future of Europe